Nordic Tax Law Bulletin - April

By seamless collaboration, the Nordic DLA Piper offices enhance their tax work, promote greater compliance, and contribute to easily accessible information on relevant tax news for businesses across the Nordics. In this special edition we present an overview of the similarities and differences in approaching the Anti-Tax Avoidance Directive (ATAD).

Summary ATAD

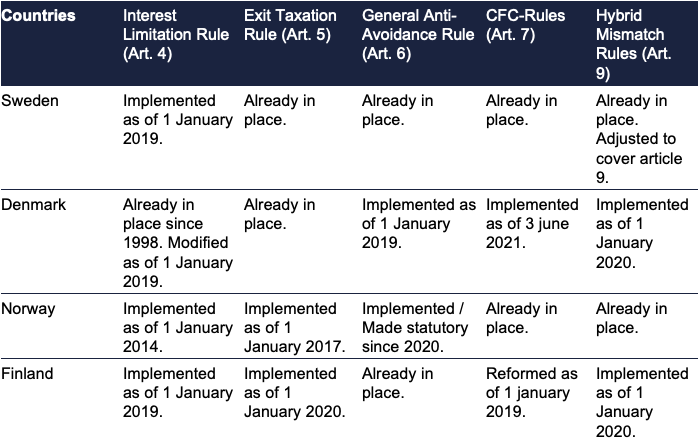

The EU has implemented several measures to combat tax avoidance and profit shifting. One such measure is the Interest Limitation Rule, which aims to reduce profit shifting through excessive interest payments, as outlined in Article 4 of the legislation. Another measure is the Exit Taxation Rule, which aims to prevent the tax-motivated movement of valuable business assets, such as intangibles, across borders (Article 5). In addition, the EU has also established the General Anti-Avoidance Rule ("GAAR") as part of their efforts to discourage artificial arrangements. This rule is detailed in Article 6 of the legislation. The Controlled Foreign Company (CFC) is another measure aimed at reducing profit shifting to low tax jurisdictions. This rule is outlined in Articles 7 and 8 of the legislation. The Hybrid Mismatch Rule is another measure included in the legislation to reduce hybrid mismatch possibilities. This rule is detailed in Article 9 of the legislation, as well as in ATAD 2. Finally, the EU has included measures to combat the misuse of shell entities in ATAD 3. These rules are aimed at circumventing the misuse of so-called "shell entities." The ATAD 3 rules are not yet in force (currently being processed in the EU Council).

ATAD 1

Summary

Sweden

As of 1 January 2019, the Swedish government implemented a general interest deduction limitation, whereby negative net interest can only be deducted up to 30% of EBITDA, or up to SEK 5,000,000 as a simplification rule. The excess non-deductible interest expense can be carried forward and used within a six-year period. However, the rules on the prohibition of interest deduction on intra-group loans will remain in effect alongside the general reduction corresponding to negative net interest, with two exemptions - the ten per cent rule and the exemption rule motivated by business reasons.

The Swedish Supreme Administrative Court (HFD 2021 ref. 68) recently ruled that the Swedish national rules concerning deduction limitation of negative net interest income conflict with EU law. The Court found that the rules limit the freedom of establishment in the EU, and cannot be justified by the purpose of preventing tax evasion and tax avoidance, as they are applicable to genuine transactions. As a result, the Swedish government has initiated an investigation of the interest reduction rules, with the results to be presented on 1 November 2023.

In terms of the guarantee of deferred taxes, the Swedish Tax Procedures Act was considered to fulfill the demands of Article 5 of the directive, which states that a guarantee can be required if there is a demonstrable and actual risk of non-recovery. However, the Swedish law imposes a stricter requirement than the directive.

Regarding the General Anti-Avoidance or Abuse Clause (GAAR), the Swedish Tax Evasion Act was deemed to fulfill Article 6, with the Swedish rules being broadly equivalent to GAAR but more invasive. Unlike GAAR, the Swedish law does not require that arrangements must be of non-genuine character, meaning even genuine arrangements can fall under it's scope. However, the Swedish law has faced criticism for potentially restricting cross-border freedoms and from a legality perspective.

Denmark

Prior to the introduction of ATAD 1, Denmark already had a number of similar anti-abuse provisions in place in Danish tax law. However, Denmark have implemented several tax rules and regulations as part of its adoption of ATAD 1.

Denmark already had certain rules in place on the limitation of interest deduction, which had been in place since 1998. At present, there are three rules in place to regulate this limitation.

1. The first is the thin capitalization test, which imposes a debt-to-equity ratio of 4:1 and applies to interest costs above DKK 10m.

2. The second rule is the asset test, which limits the deduction of interest expenses to 2.7% (2023) of the tax basis in the assets and applies to interest costs above DKK 22.3m.

3. The third rule limits the deductibility of financing costs that remain after test 1 and 2 to an amount equal to 30% of the Danish company's/tax group's taxable EBITDA income. This calculation is made on the Danish tax group level (50% votes).

Denmark has also had rules in place on exit taxation for many years, which concern taxation of the gain on shares and other assets upon emigration. Assets no longer comprised by Danish taxation will be deemed disposed, unless included in a Danish PE. For persons, the exit tax rules only apply if the person has been resident in Denmark for a total of 7 years of the last 10 years. The right to deferral of payment of taxes is available subject to certain conditions.

In 2015, Denmark introduced a general anti-abuse rule (GAAR) that was broadly in line with the EU GAAR. The scope of the GAAR was subsequently extended in 2019 to implement article 6 of ATAD 1, and it now comprises abuse of double tax treaties as well as l Danish tax law. The Danish GAAR requires that the "main purpose" or "one of the main purposes" is to obtain a tax advantage.

Denmark also had CFC rules in place, but new ATAD CFC-rules were introduced, which have been applicable for income years starting 1 July 2021. The rules were initially supposed to be implemented on 1 January 2019, but after heavy criticism from a number of Danish multinationals and scholars, the new CFC-rules were implemented on 3 June 2021, following three draft bills.

The new Danish CFC-rules constitute quite a significant change to the previous CFC-taxation regime. The new definition of parent company states that CFC income must exceed 1/3 of total income (previously 50% of taxable income), and there is an extended definition of CFC-income, including the inclusion of embedded royalties. The CFC-rules are subject to a partial substance test, which is a unique Danish implementation. The CFC-taxation from embedded royalties may be avoided if the subsidiary conducts "a substantial economic activity in relation to the intellectual property, which is supported by personnel, equipment, assets and premises." However, there are also additional conditions, such as the filing of CFC documentation.

Denmark has also implemented rules to restrict hybrid mismatches, effective from 1 January 2020. The Danish hybrid mismatch rules largely incorporate the ATAD article 9 anti-hybrid mismatches and limit the deductibility of certain costs in Denmark in hybrid mismatch situations, such as interest costs.

Norway

Norway has implemented various tax rules and regulations to prevent tax avoidance and ensure a fair and transparent taxation system. One such implementation is the general interest deduction limitation, which came into effect on 1 January 2014. This rule limits the deduction of interest costs exceeding 25% of the calculated interest deduction limitation basis ("Tax-EBITDA"). It is applicable for group companies with net interest costs exceeding MNOK 25 and non-group companies with net interest costs exceeding MNOK 5. Non-deductible interest expense can be carried forward for up to ten years.

For group companies the rule is applicable for net interest costs to related and non-related parties, and for net interest costs to related parties for non-group companies.

Under the equity-based exemption rule a company may claim full interest deductions if certain equity-to-asset ratio conditions are met.

Norway also has exit taxation rules in place since 1 January 2007, which cover the taxation of gains on shares and assets upon emigration of natural and judicial persons. The assessed tax on shares may be waived or reduced if the person relocates to Norway, and deferral of payment of taxes is also possible if satisfactory collateral is furnished.

The general anti-abuse rule (GAAR) is another measure implemented in Norway, which was made statutory in 2020 without any significant changes compared to the formerly non-statutory rule. The application of the rule requires that the main purpose of a transaction is to obtain a tax advantage. This rule applies to all taxes, not just corporate income tax.

Norway also has legislation governing taxation of Controlled Foreign Corporations (CFCs). If an owner directly or indirectly controls a company in a low-tax jurisdiction, they are taxed proportionally for the company's surplus. The notion of control typically involves owning at least half of the foreign company's shares or capital. However, taxation may be limited by tax treaty regulations.

Finally, Norway has rules to restrict hybrid mismatches. Dividends covered by the Norwegian participation exemption method are not considered tax-free if the distribution is deductible by the distributing company. Withholding tax on dividends, interest, and royalty is also implemented in Norway to curb tax avoidance. These measures aim to ensure that companies and individuals pay their fair share of taxes and promote a transparent and just taxation system in Norway.

Finland

In Finland, interest deduction limitation rules have been in place since 2014, but they only applied to interest paid to related parties. However, with the implementation of ATAD 1 on January 1, 2019, the scope of the regulation was extended, and the rules were tightened. If a company's total net interest expenses exceed EUR 500,000 in a tax year, the interest deduction limitations will apply, and the deductible net interest expenses are limited to 25% of the company's taxable EBITD. It's worth noting that net interests paid to unrelated parties are always deductible up to EUR 3 million. The interest deduction limitations are not applicable if the equity-asset ratio of the company is equal to or higher than the equivalent ratio of the group the company belongs to (balance sheet test). However, the exemption does not apply if the amount of interest paid to a significant shareholder is at least 20% of the total interest paid outside the group. Independent businesses, financial sector, and social housing production are excluded from the restrictions. Additionally, any non-deducted interest expenses can be carried forward without time limitations.

Regarding exit taxation, there was previously no general regulation in Finland. With the new regulation that came into force on January 1, 2020, exit tax applies to the transfer of assets from a head office to a PE, transfer of assets from a PE, and transfer of tax residence. It's worth noting that the rule doesn't apply to temporary transfers of funds, and the exit tax can be paid in installments over five years.

In terms of the general anti-abuse rule, no change was deemed necessary in Finland based on the Tax Avoidance Directive, as the national general clause in section 28 of the Tax Assessment Act contains the same key elements as the general tax avoidance provision in the Directive.

The CFC legislation has been in force in Finland since 1995. Still, as of January 1, 2019, it was significantly reformed as a part of ATAD, with the most essential changes relating to the calculation of the control/ownership level and the so-called escape-rules. Additionally, non-residents can now be taxed on their share of CFC's income if their share is connected with a PE located in Finland.

Lastly new legislation regarding hybrid mismatch rules came into force on January 1, 2020, addressing the exploitation of double deduction mismatches, deduction without inclusion mismatches, mismatches arising through structured arrangements, and mismatches arising through different treatment of the allocation of income and expenditure between a PE and its head office. The legislation sets rules regarding denial of deduction or inclusion of income in the taxable base to avoid the mismatch situations.

ATAD 2

Summary

Sweden

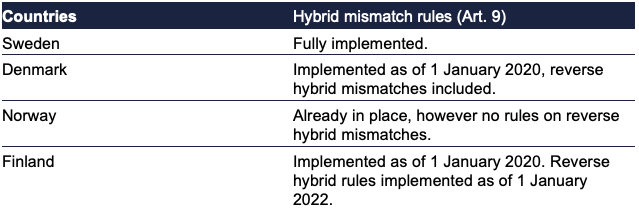

In Sweden, there were previous laws in place to restrict hybrid mismatches, which are situations where taxpayers take advantage of differences in the tax treatment of financial instruments or entities between different countries to achieve a tax advantage. However, the old rules only applied to interest deduction limitation rules. To address this issue more comprehensively, new rules were implemented to cover a wider range of situations involving hybrid mismatches. These new rules have since been fully implemented into Swedish law, ensuring that taxpayers are no longer able to exploit these mismatches to achieve a tax advantage.

Denmark

Denmark has implemented the ATAD 2 directive, which includes rules on reverse hybrid mismatches. These rules were effective from 1 January 2020 and are part of the new Danish hybrid mismatch rules. An example of this is when a permanent establishment (PE) of a Danish company in another jurisdiction is not treated as a PE in that jurisdiction. In such a case, the taxable income will be allocated to Denmark, thereby ensuring that the income is not subject to double non-taxation. The purpose of these rules is to prevent companies from exploiting differences in the tax treatment of entities and instruments in different jurisdictions to achieve a tax advantage.

Norway

Norway has not implemented specific rules on reverse hybrid mismatches under ATAD 2, though it has measures in place, such as the CFC rules, which can to some extent address the tax advantages resulting from such mismatches.

Finland

In Finland, the implementation of ATAD 2 has brought about new legislation related to reverse hybrid mismatches. These rules have been in force since 1 January 2022. The new legislation stipulates that non-resident partners of Finnish partnerships will be required to pay taxes on the income of a reverse hybrid entity in Finland if certain conditions are met. A reverse hybrid entity refers to a situation where a Finnish partnership, which is considered to be fiscally flow-through unit in Finland, is considered a separate taxpayer under the laws of another state.

ATAD 3

Summary

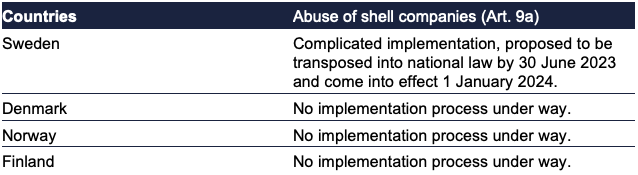

Please note that all four countries may, in general, prevent the abuse of shell companies and limit tax benefits for companies with little or no substance e.g. based on the GAAR rules.

Sweden

ATAD 3 in Sweden seeks to prevent tax benefits from being claimed by foreign companies with little substance and earning certain types of income for tax planning purposes. The proposed directive defines which incomes and circumstances can trigger higher taxation and outlines a series of tests to assess a company's substance. Companies that do not meet the necessary criteria and are considered shell companies will be subject to penalties and measures. The rules are set to come into effect on 1 January 2024, with retroactive effect from 2022.

The implementation of these rules in Sweden has been a complicated process from a legal perspective, as the proposal requires a multi-step assessment. Consultation bodies in Sweden have provided input on various issues, including the comparison of the new rules with existing EU tax instruments to target shell entities, the definition of a "shell entity," and concerns regarding proportionality, legal certainty, and predictability. Additionally, risks and opportunities for clients, administration, discrimination, and potential arbitrariness between member states have also been considered. Despite these challenges, Sweden is committed to implementing the rules in accordance with the transposition deadline of 30 June 2023.

Denmark

Currently, there is no implementation process underway in Denmark for the ATAD 3 directive, which focuses on tackling the abuse of shell companies. However, it's worth noting that Danish tax benefits for "shell companies" are already quite limited due to the substance requirement in the Danish GAAR and beneficial owner requirements. This is similar to Norway's approach to tackling the abuse of shell companies.

Norway

Currently, there is no implementation process underway in Norway regarding the abuse of shell companies. However, the Norwegian tax system already has measures in place to limit tax benefits for companies with insufficient substance, including shell companies.

While Norway has not yet implemented any specific rules on the abuse of shell companies under ATAD 3, the substance requirement in the Norwegian participation exemption method serves as a measure to prevent tax abuse through the use of such companies.

Finland

Currently, there is no implementation process in Finland for ATAD 3, which specifically addresses the abuse of shell companies. Therefore, no new legislation has been introduced in Finland in relation to this aspect of the ATAD 3.